How to invest for your clients

The APN AREIT Fund and APN Asian REIT funds are available on our mFund platform. Simply place an order online through the order pad:

1. Login to your account and go to the order pad.

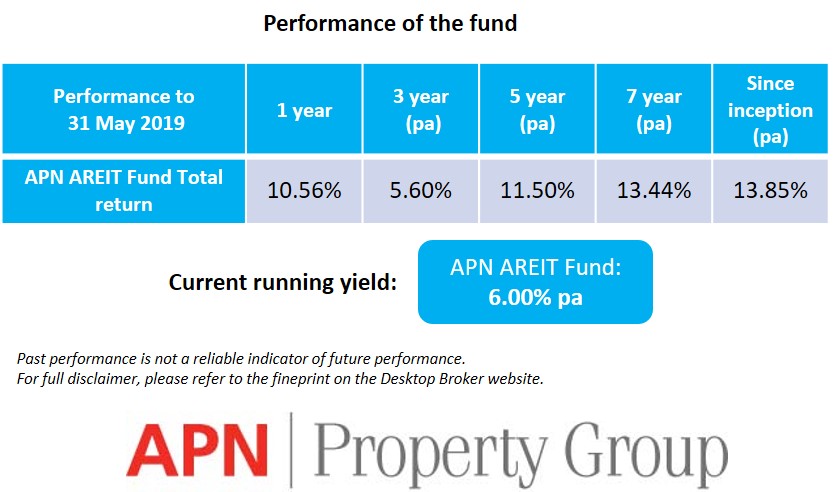

- The mFund code for the APN AREIT Fund is APF01.

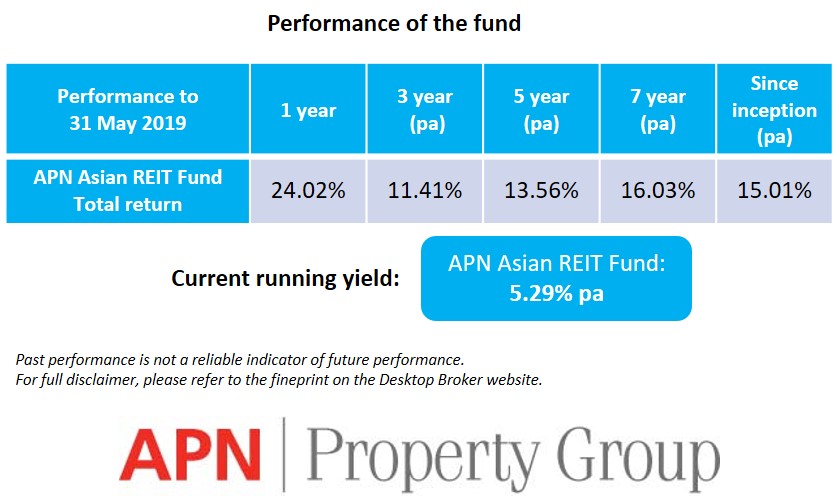

- The mFund code for the APN Asian REIT Fund is APF02.

2. Read the fund profile and the Product Disclosure Statement.

3. When you're ready to invest, choose the ‘Managed Funds’ option on the Order Pad and place your order online.

4. Your new mFund units are transferred and can be seen in your clients' portfolios

No need to provide any additional paperwork from your clients, the Fund will settle through their existing nominated bank account.

.PNG)

_(1).jpg)