Advice business models are evolving, fuelled by the changing economic conditions, according to Desktop Broker’s Head of Distribution Tim Sparks.

Key takeouts

- In an environment of global economic and political uncertainty, rising interest rates and inflation, allocations to cash and fixed interest are rising.

- Consistent returns of 8-10% per annum from equities will be harder to deliver, putting pressure on financial advice businesses that hinge value propositions solely on delivering performance.

- The popularity of managed accounts continues to rise. An increasing number of advisers are outsourcing investment management responsibilities to third parties for certain segments of their clients.

- Desktop Broker is a financially stable trading platform for advisers and can help them save time on investment selection, portfolio construction and compliance.

Desktop Broker’s Head of Distribution Tim Sparks

Desktop Broker’s Head of Distribution Tim Sparks

The fear of missing out (FOMO) is a bona fide condition. Not only is it rampant in high schools, it’s on full display in investment markets.

It’s the reason why people pay massive overs for dilapidated properties on the city’s outskirts and pile into cryptocurrency at the height of the market.

But FOMO, at least when it comes to investing, is dissipating. The fear of missing out is being surpassed by the fear of paying too much and losing money.

This is reflected in soft auction clearance rates in the property market and weak trading volumes on the Australian Securities Exchange.

For much of 2022, auction clearance rates have hovered around 60%, compared to 80% in 2021.

Capital city auction clearance rates October 2022 v October 2021

Source: Corelogic

Source: Corelogic

Similarly, retail share trading volumes fell 13% in the nine months to September 30, 2022, compared to the previous corresponding period.

Investor jitters are normal, especially in an environment of rising interest rates and inflation, but today’s pessimism feels different to past years.

In a relatively short period of time, cautiousness has replaced irrational exuberance and completely bypassed cautious optimism.

This is impacting how investors and advisers construct portfolios.

Investor behaviour is changing

In early 2020, when COVID-19 was declared a global pandemic by the World Health Organisation and stock markets tumbled, investors treated volatility as a buy-the-dip opportunity.

For many years prior, a significant number of potential investors had sat on the sidelines as prices rose higher and higher. In their minds, they had missed the boat once and weren’t going to miss it again. FOMO led them to ride the recovery.

This time, investors are properly spooked by a culmination of factors including Russia’s invasion of Ukraine, the resulting European energy crisis, and global supply chain bottlenecks; part of the COVID-19 hangover.

There are also concerns that elevated levels of corporate debt could derail growth, particularly in developed countries.

Investors are bracing for longer-term headwinds.

As such, allocations to defensive asset classes like cash and fixed interest are rising. According to Rainmaker, bonds with credit and high yield characteristics saw an increase in net inflows of 13% for the 12 months to June 30, 2022.

As at 31 March 2022, self-managed superannuation funds (SMSFs) – a proxy for retail investor behaviour – held almost a quarter of assets in cash and fixed income, made up of 12.2% in cash and short-term deposits, 8.4% in Australian fixed interest and 2.1% in international fixed interest.

ARPA-regulated super funds held 27% of assets in cash and fixed income.

Table heading: Asset allocation of SMSFs v Small APRA funds

Source: SuperConcepts

Source: SuperConcepts

Why the return of more normal market conditions is sparking a rethink of advice models

After almost 30 years of uninterrupted prosperity, Australia is moving into an extended period of heightened economic uncertainty.

Since the 1991 recession, domestic prosperity has been underpinned by strong immigration and population growth, and a mining and resources boom.

Whether by good luck or good management, Australia came out of the Global Financial Crisis relatively intact and, so far, the economic impact of COVID-19 has been mild.

In fact, COVID-induced fiscal and monetary stimulus has artificially propped up the economy.

But the economic landscape and, in turn, the business operating environment is changing.

This is causing financial advice businesses to rethink their business models, particularly those that hinge their value proposition on picking investments and delivering returns.

A key trend in recent years has been the rise of managed accounts.

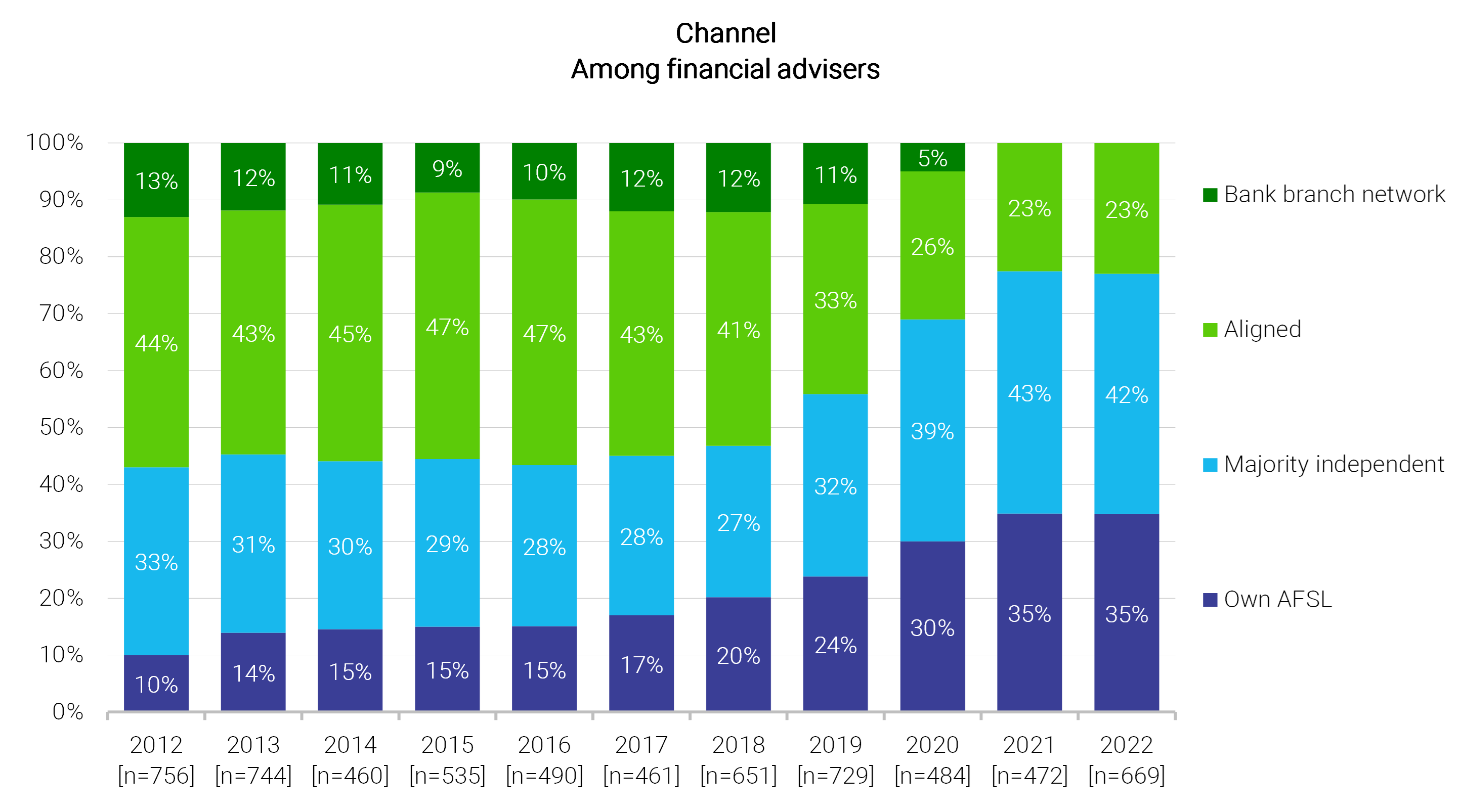

In 2021, more than half of advisers used managed accounts for their clients, up from 44% in 2020 and 16% a decade ago, according to Investment Trends.

With managed accounts, advisers can tailor portfolios to suit a client’s unique needs and objectives.

They can execute trades and rebalance portfolios at their discretion, in line with a client’s risk profile and investment strategy. This reduces the number of ongoing client approvals and significantly reduces the compliance burden.

However, a growing number of advisers are also choosing to outsource investment management responsibilities to third parties for certain segments of their clients. One such segment is clients with lower investment amounts.

A decade ago, when managed accounts were basically only used by a small number of predominately self-licensed businesses, investment decisions were largely made internally. Advisory firms established three-to-four-person investment committees, sometimes appointing an independent member. These investment committees determined and executed the group’s investment strategy including strategic and tactical asset allocation.

As a large number of advice businesses left institutional dealer groups, the managed account trend accelerated. Former institutional advisers relished the ability to invest in direct assets and make decisions, uninhibited by heavily restricted approved product lists.

While this model is still relevant and common today, it is under pressure.

The advice models facing increasing pressure

It is one thing to build and manage portfolios during a period of unprecedented economic prosperity, it’s quite another to do it under normal market conditions.

Over the last 20-30 years, investors have become used to consistent returns in the vicinity of 8-10% per annum from equities.

With more conservative returns on the horizon, advisers can expect greater scrutiny of their investment philosophy, processes and performance, not only from clients but potentially from regulators.

Some are choosing to partner with an independent asset consultant or fund managers to help scale their advice delivery, manage business risk and ensure their clients’ expectations are realistic.

This approach is also freeing them up to spend more time seeing existing clients and winning new client business.

It has created an efficient, scalable solution for all clients including relatively low value, low account balance clients.

Inside most advice businesses there is a long tail of ‘C&D’ or lower balance clients who only interact with an adviser on a sporadic basis.

With managed accounts, advisers are reengaging C&D clients and offering tailored investment management solutions and ongoing communications and performance updates in a scalable way through technology provided by trading platforms such as Desktop Broker.

Where advisers can add the most value

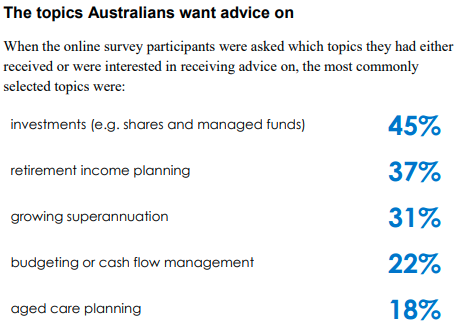

Financial advisers add value in many different ways. Their role is so much broader than investment management and administration, including advice on budgeting and cashflow management, debt, superannuation, tax, Centrelink, retirement planning, estate planning and aged care.

In an environment where it will be harder and harder to beat the benchmark, advisers will look to anchor their value proposition on something other than investment performance.

The behaviour of investment markets and the direction of interest rates are beyond anyone’s control, making it important for advisers to focus on areas where they can add the most value.

That includes areas like financial education, goal setting and strategic retirement planning. In an environment of heightened volatility, regular client communications and interaction is critical to ensure investors don’t panic and deviate from their strategy.

Rethink the way you deliver investment performance

Desktop Broker is a financially stable trading platform for financial advisers. Our experienced adviser support team can help you save time on investment selection, portfolio construction and compliance.

We can move your advice practice to solid ground. Simply organise a time to talk to us about what your business needs by clicking here.