Almost 25 years after the government introduced mandatory super, it has defined its primary objective: “to provide income in retirement to substitute or supplement the Age Pension.”

This gives far greater prominence to the role of the Age Pension in Australia’s retirement system than in the past.

It is also substantially different to the natural objective of most funds: to help members save for an adequate– preferably comfortable– retirement lifestyle.

Both of these objectives are, in turn, different from the actual goals of many members.

How will these mismatches change the way funds operate?

The Age Pension: A large safety net

The new legislative objective suggests that super is not the sole key to retirement, but just one piece of the puzzle alongside the Age Pension, housing and other savings.

The Age Pension is the perfect retirement income stream. It is guaranteed by government, provides a lifetime income and is indexed to inflation.

Of the three retirement pillars (the Age Pension, super and private savings), it is by far the largest. While Australians collectively now have more than $2 trillion in super savings, about 70% of retirees still receive some form of the Age Pension and Treasury forecasts suggest that this may only fall slightly to about 67% by 2055.

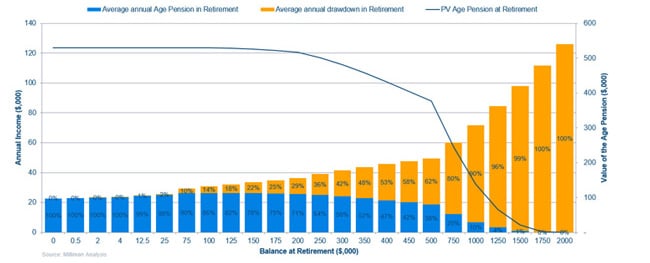

Despite its prominence, the Age Pension’s impact on retirement outcomes is often neglected. The table below shows just how much the Age Pension subsidises annual retirement incomes at various retirement balances.

Value of the age pension

Source: Milliman analysis

Given the average super balance at retirement in 2013-14 was $292,500 for men and $138,150 for women (and median figures far lower at $100,000 for men and $28,000 for women), it is clear that the Age Pension will remain a significant element of support in the near future.

Lifestyle risk: The new longevity risk

Longevity risk is real: the growing probability that many members will outlive their retirement savings as lifespans continue to increase.

But if the Age Pension is intertwined with the objective of super, then longevity risk is not a significant issue for superannuation funds, where many members retire with relatively low account balances or incomes.

The Age Pension will underpin their (albeit frugal) lifestyle until they die. The diagram above shows that for many members, increasing their super will have little impact on their retirement incomes as the Age Pension tapers off.

Fund members with considerably higher balances– or more importantly annual incomes which typically peak in later years– face a bigger dilemma.

This is better described as “lifestyle risk”– the odds that members are unlikely to be able to maintain a similar lifestyle throughout retirement– rather than longevity risk.

But helping members to tackle this risk requires far more than making broad-based assumptions, such as using retirement adequacy tables as a target.

Funds need to perform a deep analysis (including the impact of the Age Pension) using technology and analytics, using a range of datasets, to find out what the actual objectives of their members are.

This information should ultimately flow into advice, education and product design, bolstering engagement and retention along the way.

This is the only path for funds that want to maximise the chances that members will achieve their personal retirement goals– and that is a more than worthy objective of super.

The article was first published on Milliman website.

Disclaimer

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.