SMSF members with higher risk appetites wanting to leverage an investment within their fund have traditionally borrowed to buy commercial or residential property. Indeed, most might assume this is their only option for gearing within superannuation.

However, SMSF rules also allow borrowing to invest in equities and other listed securities. In this article:

- we’ll look at the merits of doing so,

- the different approaches available, and

- the rules which facilitate borrowing in superannuation.

Why gearing?

Gearing as a strategy relies on the investor having an expectation that the total return on their investment over their time horizon will exceed the cost of gearing.

Gearing magnifies the positive and negative impacts of price changes on an investor’s initial equity. This risk of negative impacts can be managed by strategies like diversification and conservative leverage. The portfolio should be managed over time rather than simply setting and forgetting.

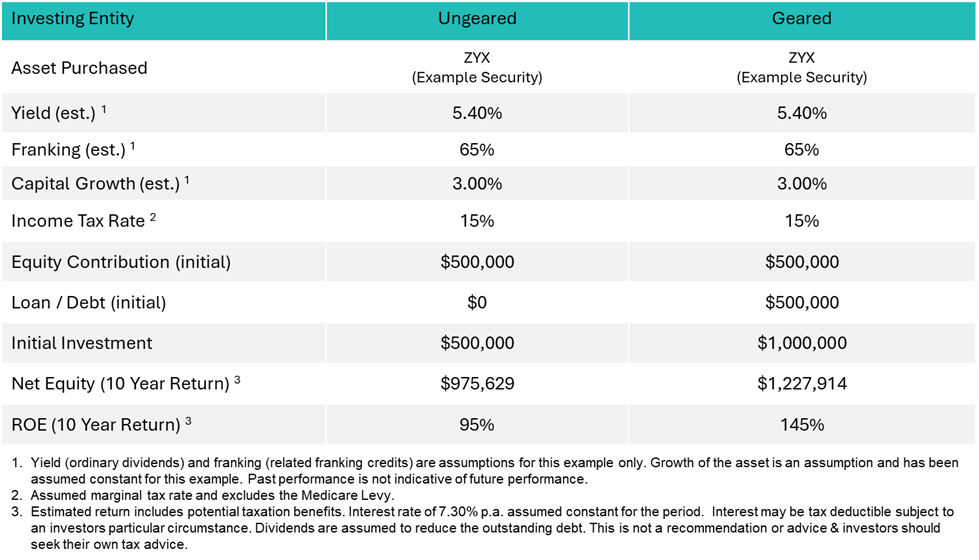

In the hypothetical scenario in the table below we modelled a detailed cash flow analysis of an investment with a balance between income and capital growth; geared at 50%.

The result was a 10-year return on equity (ROE) of 145% for the geared investment compared with just 95% for the ungeared equivalent.

Example 1: Comparing a geared vs ungeared investment

Source: Bell Potter Capital

Source: Bell Potter Capital

Equities or Property?

Gearing to buy property is popular with many SMSFs and the main contributor to the $59 billion in LRBA loans to SMSFs, as at late 2023^. However, property can have its downsides. Australia’s high real estate prices often mean a big gearing commitment, especially since the fund’s existing assets can’t be used as collateral and may see an SMSF end up with nearly all its collective value tied up in a single property. Legislative uncertainty and political risk around the future of property gearing only adds to the mix.

By contrast, gearing to buy equities provides flexibility, liquidity and diversification—and enables an SMSF to start small with gearing and be highly conservative in its borrowing.

Unlike property, where you cannot just ‘sell a bathroom’, share investors can sell part of their portfolio. For example, if a share price rises the investor can sell some shares to lock in profit and reduce gearing. Again unlike property, shares can be sold and settled very quickly.

Methods of Gearing Equities in Super.

Despite the appeal of borrowing to invest in equities for some SMSFs, very few lending options are available in Australia. At Bell Potter Capital (BPC), we offer two products to support the differing needs of brokers, advisers and their SMSF clients, both of which were designed with the relevant regulation in mind.

Firstly, we will look generally at gearing in super and then focus on the two Bell Potter Capital products. The principles underlying the products are generally applicable to other SMSF gearing solutions.

There are several ways to gear investments in superannuation. These include the use of derivatives and managed funds with embedded gearing. In this article we focus on methods where the investor directly owns the investment and borrows to fund part of the purchase price.

There are two methods commonly used:

- Establish a Limited Recourse Borrowing Arrangements (LRBA), which complies with SMSF laws. Bell Potter Capital’s Super Lending product is designed to use this approach.

- Instalment receipts or warrants use a different mechanism (incurring a debt). Bell Potter Capital’s Equity Lever product operates in this way by offering custom instalment receipts which are unlisted.

These approaches give the investor control over the arrangement and beneficial ownership of the investment.

Both approaches share some common features and can be used to achieve similar investment outcomes. Each method requires the purchase of a single asset. In the cases of listed equities this is essentially a parcel of shares bought at one time (a contract note). In both cases the arrangements are limited recourse, and the assets are held by a security trustee. We will explore this further by looking at examples of Bell Potter Capital’s products.

Both approaches also benefit from a relatively simple product establishment, unlike property where investors need to establish specific legal arrangements and bear the cost of that.

Bell Potter Super Lending

Bell Potter Super Lending is a limited recourse margin loan we designed specifically to comply with the SIS Act. It can consist of multiple loans, each secured separately, and can be used to partly fund selected S&P/ASX100 securities, international securities and ETFs. Because of the limited recourse nature LVRs are generally limited to 50%.

Brokers can place buy or sell orders in the usual way with shares held in the name of the security trustee in a separate HIN for each SMSF, with each parcel of shares then identified against the individual loan which funded its purchase.

The rules for investment loans within super differ from non-super margin lending. SMSF loans are classed as Limited Recourse Borrowing Arrangements (LRBA), under which money can only be borrowed to buy a single asset (e.g. a property) or a collection of identical assets (e.g. a parcel of shares in one company bought at the same time).

When a new loan is established, the investor must provide their cash component (generally 50% or greater). The investment is then purchased on market with the lender providing the balance of funds at settlement. Other assets of the SMSF cannot be used as collateral. Cash advances against an asset are not permitted under SMSF laws.

If shares prices fall, one of more of the loans may suffer a margin call. The investor can choose whether or not to meet the margin call. If the investor does not meet the margin call, the lender can sell the underlying asset to recover the loan and return any excess to the investor. If there is a deficit the lender cannot pursue the underlying client for this amount.

Bell Equity Lever

Our second option, Bell Equity Lever, works a bit differently, albeit to achieve the same long-term result. It provides leverage by investing in custom Instalment Receipts. The leverage is internalised in the Instalment Receipt. This makes it simple for financial advisers to submit buy or sell requests to BPC via our website, and we then execute the trades. With Equity Lever, Bell Potter Capital purchases the underlying asset on market and attaches the debt which creates the instalment receipt.

The assets are held by a security trustee, with the underlying client retaining beneficial ownership.

Unlike Super Lending, Equity Lever is a consolidated facility where the degree of leverage is calculated across the full portfolio of instalment receipts. Like a margin call, an ‘instalment acceleration event’ is triggered if the maximum LVR is exceeded.

When making a purchase of new instalments, any surplus capacity in the facility can be utilised to assist funding a new purchase. This is more akin to a traditional margin loan.

Advantages of Gearing in SMSF.

For risk-tolerant SMSF members, gearing an investment (whether property or equities) can further fuel returns because of the advantageous tax rates within super, from lower income tax and CGT rates to zero tax rates on income and CGT when in Pension phase. And as with non-super investment loans, interest payments may be tax deductible.*

So what do these preferential tax rates mean for an SMSF? Again assuming a 50% gearing rate, annualised return and identical assumptions as our example above, the chart below compares the outcomes for an individual investor and an SMSF.

This time, the result is a 10-year ROE of 145% for the SMSF versus 102% for a top rate taxpayer outside super.

Example 2: Ten year return on equity for an individual investor vs an SMSF

Source: Bell Potter Capital

Source: Bell Potter Capital

Managing investment risk

Whether inside super or not, gearing is riskier than ordinary investing since it can increase the magnitude of capital losses, added to the risk of interest rate hikes or changes to tax legislation.

Most Australians and their advisers (not to mention ASIC and other regulators) would rightly regard superannuation as almost sacrosanct—the financial reward for a lifetime’s work and the key to a comfortable retirement. However, gearing risk can be managed within an SMSF with prudent stock selection and conservative gearing.

The nature of loans in super also mitigates portfolio risk because the lender’s rights in case of default are limited to the secured asset(s). In other words, the SMSF’s other assets held external to the facility are never in jeopardy.

Legislative and regulatory risks

Considerations around compliance with the Superannuation Industry Supervision Act (SIS Act) and the ATO’s strict rules governing SMSF borrowing may act as further deterrents for some clients.

However, borrowing to leverage equities needn’t mean an additional administrative burden. For example, applying for an SMSF gearing facility doesn’t require the SMSF to change their annual audit and tax processes. Most SMSF auditors are familiar with gearing requirements for SMSFs and will simply add this to their audit process.

The lender establishes the bare trust for the client when the loan is set up and this is part of our standard product documentation.

In some cases, SMSF Trust Deeds may need to be varied to permit borrowing.

Like to know more?

Full details of our SMSF equity lending products are available via info@bellpottersecurities.com.au, by contacting Marty Johnston, Head of Partnerships, on 0417 288 960, and in the Super Lending and Equity Lever PDSs.

Important disclaimer:

This information has been prepared by Bell Potter Capital Limited ABN 54 085 797 735, AFSL 360 457 (Bell Potter Capital). This information is of a general nature only and does not take into account the personal objectives, financial situation or needs of any particular investor. Before making a decision about investing, you should consider your financial requirements and if necessary, seek appropriate independent financial, legal, taxation or other advice. This information is believed to be correct at the time of compilation but is not guaranteed to be accurate, complete or timely. Bell Potter Capital and its related bodies corporate do not accept any liability arising out of the use or distribution of this information.

****

*Interest may be tax deductible up to a benchmark set by the ATO (Reserve Bank of Australia’s Indicator Lending Rate for Standard Variable Housing Loans – Investor plus 100 basis points).

^ Surging SMSFs, The Adviser, 13 December 2023